Safeguarding Success: Bagley Risk Management Services

Safeguarding Success: Bagley Risk Management Services

Blog Article

Just How Animals Risk Defense (LRP) Insurance Can Safeguard Your Animals Investment

Animals Risk Protection (LRP) insurance policy stands as a reputable guard versus the unforeseeable nature of the market, offering a tactical approach to securing your properties. By diving right into the ins and outs of LRP insurance and its complex advantages, animals producers can strengthen their financial investments with a layer of protection that transcends market changes.

Recognizing Animals Danger Security (LRP) Insurance Coverage

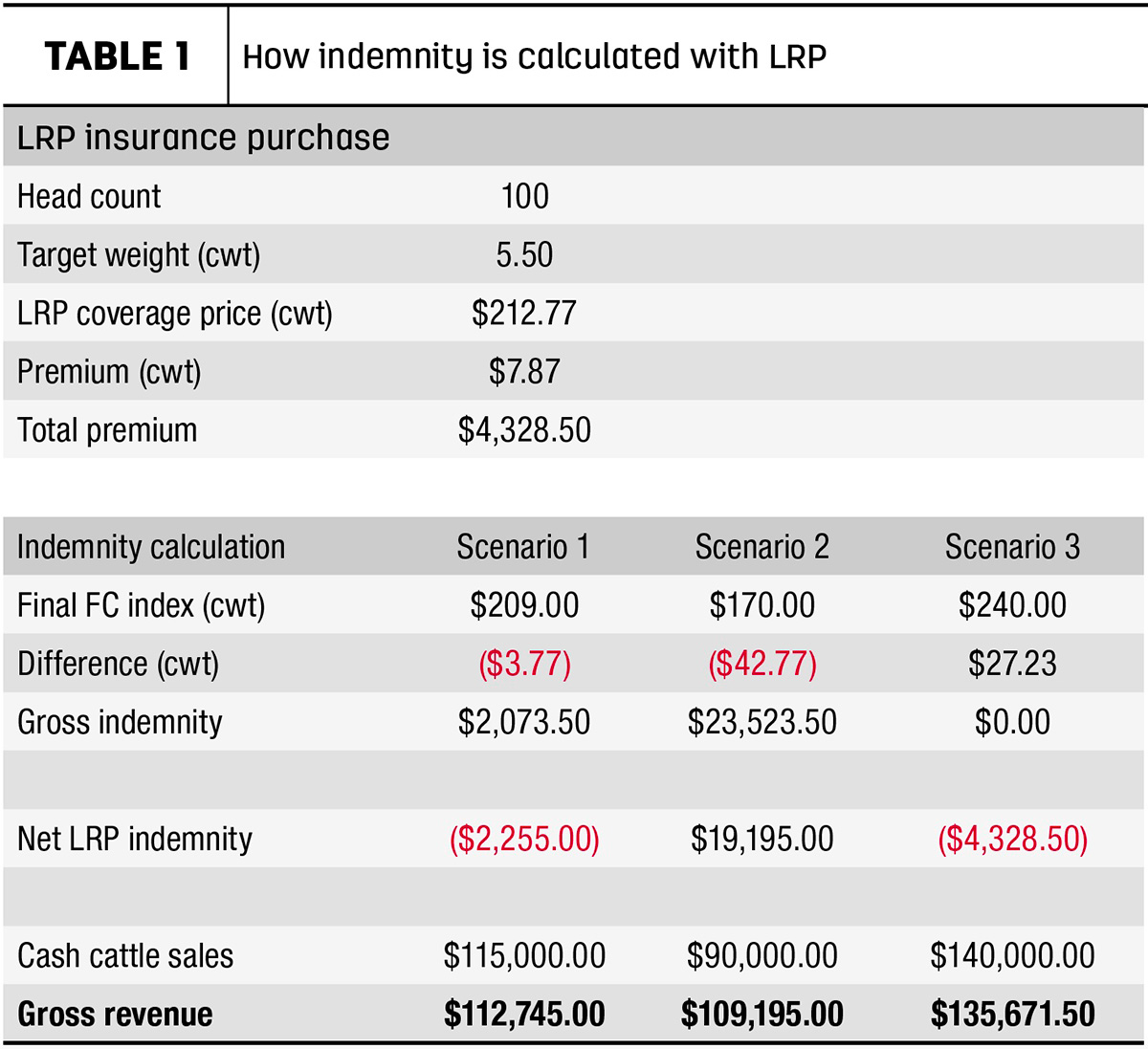

Recognizing Livestock Risk Protection (LRP) Insurance policy is crucial for animals manufacturers looking to mitigate economic risks connected with price variations. LRP is a government subsidized insurance item created to safeguard manufacturers against a decrease in market rates. By supplying insurance coverage for market price decreases, LRP assists producers secure in a floor price for their livestock, making sure a minimal level of earnings despite market variations.

One key facet of LRP is its versatility, enabling manufacturers to customize insurance coverage levels and plan sizes to match their details demands. Producers can choose the number of head, weight range, insurance coverage cost, and insurance coverage period that line up with their production goals and run the risk of tolerance. Comprehending these adjustable options is essential for producers to properly manage their cost danger exposure.

In Addition, LRP is available for numerous animals types, consisting of livestock, swine, and lamb, making it a functional danger management tool for animals producers throughout different sectors. Bagley Risk Management. By familiarizing themselves with the intricacies of LRP, manufacturers can make informed decisions to safeguard their investments and guarantee economic stability despite market uncertainties

Advantages of LRP Insurance Policy for Animals Producers

Animals manufacturers leveraging Livestock Danger Defense (LRP) Insurance policy obtain a critical benefit in securing their financial investments from cost volatility and securing a secure monetary ground in the middle of market unpredictabilities. By setting a flooring on the price of their livestock, producers can mitigate the threat of considerable monetary losses in the occasion of market downturns.

In Addition, LRP Insurance coverage gives manufacturers with tranquility of mind. Overall, the advantages of LRP Insurance coverage for livestock producers are considerable, using a useful device for managing danger and guaranteeing monetary security in an uncertain market atmosphere.

Exactly How LRP Insurance Policy Mitigates Market Threats

Alleviating market threats, Livestock Risk Security (LRP) Insurance offers livestock manufacturers with a reputable guard against cost volatility and economic uncertainties. By providing defense against unanticipated price drops, LRP Insurance coverage helps producers protect their financial investments and maintain monetary stability when faced with market changes. This kind of insurance coverage permits livestock manufacturers to secure a cost for their pets at the start of the policy duration, guaranteeing a minimum cost level regardless of market adjustments.

Actions to Protect Your Animals Investment With LRP

In the realm of agricultural danger administration, applying Animals Danger Defense (LRP) Insurance policy includes a calculated procedure to protect investments versus market variations and uncertainties. To protect your livestock investment efficiently with LRP, the first step is to analyze the details threats your procedure deals with, such as rate volatility or unexpected weather condition events. Next off, it is critical to research study and select a credible insurance coverage provider that provides LRP plans customized to your animals and organization requirements.

Long-Term Financial Safety With LRP Insurance Coverage

Making sure enduring monetary stability with the use of Livestock Danger Security (LRP) Insurance is a sensible lasting strategy for agricultural producers. By including LRP Insurance into their risk administration plans, farmers can protect their animals investments versus unforeseen market changes and damaging events that could jeopardize their monetary well-being over time.

One key benefit of LRP Insurance for long-term economic security is the satisfaction it offers. With a trustworthy insurance coverage plan in location, farmers can minimize the economic dangers related to unstable market conditions and unforeseen losses because of variables such as disease outbreaks or natural calamities - Bagley Risk Management. This security permits manufacturers to click to read more concentrate on the everyday operations of their animals company without continuous concern regarding potential economic setbacks

Furthermore, LRP Insurance gives a structured method to taking care of risk over the lengthy term. By establishing particular coverage levels and picking proper recommendation durations, farmers can tailor their insurance coverage intends to align with their monetary objectives and run the risk of tolerance, guaranteeing a safe and secure and sustainable future for their animals operations. Finally, spending in LRP Insurance is a positive technique for agricultural producers to achieve enduring monetary security and secure their resources.

Verdict

In final thought, Livestock Danger Defense (LRP) Insurance is an important tool for animals producers to mitigate market risks and protect their financial investments. It is a wise selection for guarding animals financial investments.

Report this page